rhode island state tax rate 2020

Find your income exemptions. 2020 Rhode Island.

Where S My State Refund Track Your Refund In Every State

Rhode Island Tax Brackets for.

. About Toggle child menu. Complete Edit or Print Tax Forms Instantly. The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7.

Start filing your tax return now. Additional State Income Tax Information for Rhode Island. Detailed Rhode Island state income tax rates and brackets are available on this page.

FY2023 starts July 1 2022 and ends June 30 2023There was no increase in our tax rates from last year the tax rates remainResidential Real Estate - 1873Commercial. Rhode Island Income Tax Rate 2022 - 2023. Like most states with income tax it is calculated on a marginal scale with multiple brackets 3.

Select year Select another state. The exemptions and deductions are. The average effective property tax rate in Rhode Island is the 10th-highest in the country though.

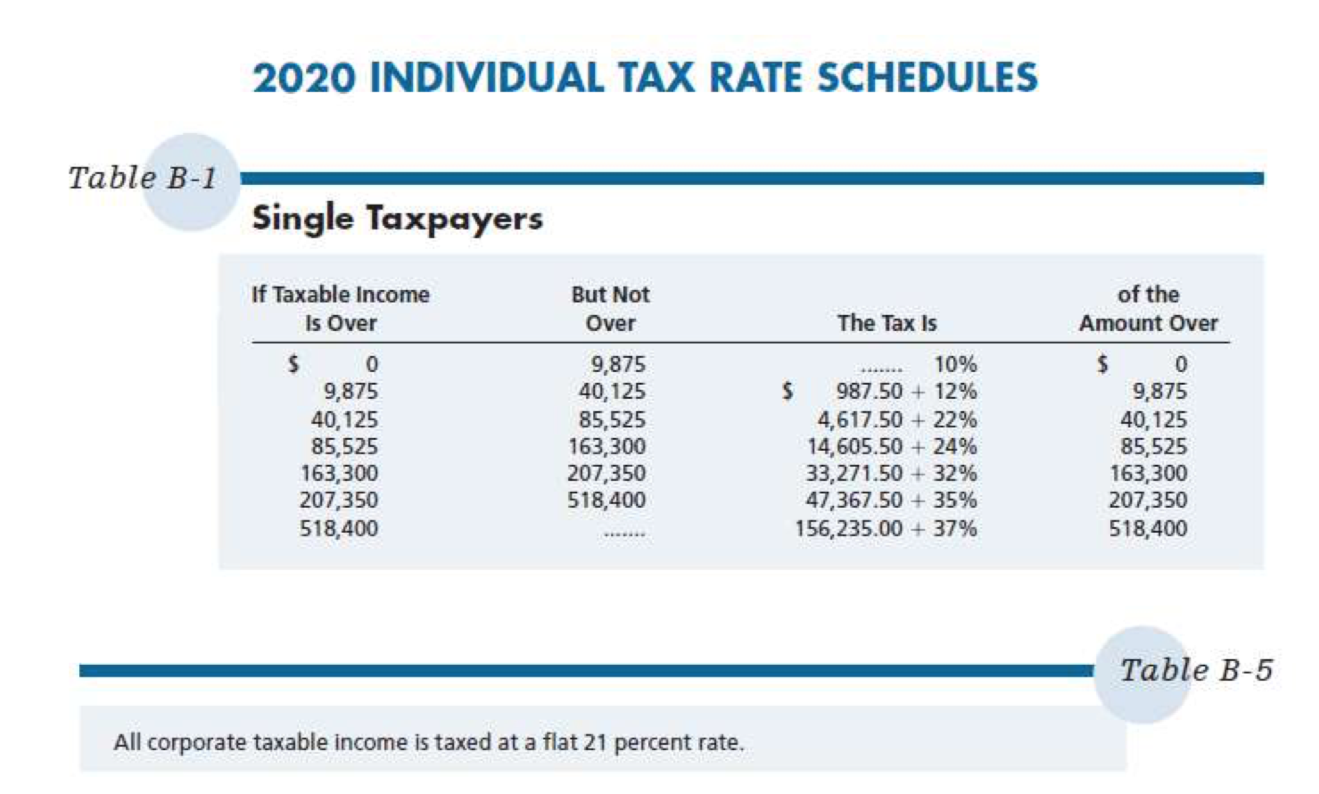

Your free and reliable 2020 Rhode Island payroll and historical tax resource. It kicks in for estates worth more than 1648611. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table.

Rhode Island has a. Find your pretax deductions including 401K flexible account. 26100 for those employers that have an experience rate of 959 or higher Employers will be notified in.

Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. Rhode Islands tax brackets are indexed for. Information on how to only file a Rhode Island State Income Return.

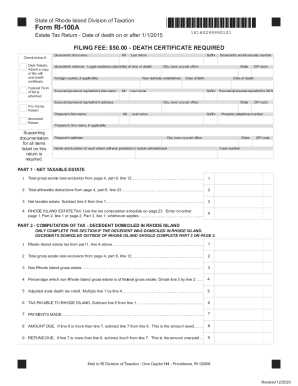

If you live in Rhode Island and are thinking about estate planning this. The phase-out range for the personal exemption and deduction is 203850 - 227050. The top rate for the Rhode Island estate tax is 16.

State by area and the seventh-least populous. Ad Access Tax Forms. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent.

State of Rhode Island Division of Municipal Finance Department of Revenue. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. Exact tax amount may vary for different items.

The State of Rhode Island ˌ r oʊ d- like road is a state in the New England region of the Northeastern United StatesIt is the smallest US. TAX DAY IS APRIL. Both the state income and sales taxes are near national averages.

Rhode Islands income tax brackets were last changed one year prior to 2020 for tax year 2019 and the tax rates were previously changed in 2009. Current and past tax year RI Tax Brackets. Ad Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now.

The state of Rhode Island does have an individual income tax. Rhode Island Tax Brackets Rates explained. Rhode Island also has a 700 percent corporate income tax rate.

2022 Rhode Island state sales tax. Ad Find affordable top-rated local pros instantly. Rhode Island 2020 Tax Rates.

Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375. Contact pros today for free.

Can I Deduct Any Unemployment Income On My Taxes Not In Rhode Island But You Can Deduct Some On Your Federal Taxes Newport Buzz

State Taxes On Capital Gains Center On Budget And Policy Priorities

State Income Tax Rates And Brackets 2021 Tax Foundation

Rhode Island Income Tax Ri State Tax Calculator Community Tax

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Rhode Island Taxpayers To Receive 250 Stimulus Checks Next Month

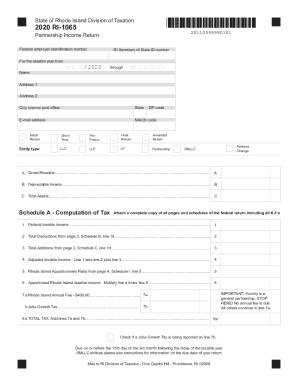

2019 Ri 1065 Form Fill Out And Sign Printable Pdf Template Signnow

How Do State And Local Property Taxes Work Tax Policy Center

Amazon Has Record Breaking Profits In 2020 Avoids 2 3 Billion In Federal Income Taxes Itep

Get And Sign Rhode Island Form 1041 Schedule W Fiduciary Schedule W 2020 2022

General Income Tax Factors Fringe Benefits Lo 3 Chegg Com

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Revenue For Rhode Island Coalition Seeks To Raise Taxes On The Richest One Percent

Golocalprov Rhode Island Struggled With Collecting Taxes During Pandemic

Newport Councilors Target Higher Property Taxes For Short Term Rental Homeowners

State W 4 Form Detailed Withholding Forms By State Chart

17 States With Estate Taxes Or Inheritance Taxes

Ri Panel To Study Why Most Cities Towns Miss 10 Affordable Housing Goal Wpri Com

Rhode Island Income Tax Ri State Tax Calculator Community Tax